Day: January 6, 2025

-

Are Personal Loans Tax Deductible In India?

A person reviewing personal loan documents and tax guidelines, highlighting scenarios where interest and principal on personal loans may be deductible under India’s Income-tax Act, including business use and home property construction. Quick personal loans are becoming increasingly popular, especially with the rise of instant personal loan platforms. As these loans are unsecured and can…

-

What is Credit Footprint and How to Maintain a Good Credit Score?

In the fascinating world of personal finance, credit scores are one of the most important factors determining an individual’s financial health. Whether it’s securing a loan, applying for a mortgage, or qualifying for a credit card, your credit score plays a pivotal role in unlocking access to these financial products. But what exactly is a…

-

Building a Rock-Solid Emergency Fund

Person saving money for emergency fund with coins and calculator, representing financial preparedness and budgeting for unexpected expenses. From unexpected medical bills to car trouble that appears quicker than your auto rides, emergencies can leave your wallet feeling drier than chapped lips in the summer sun. That’s why having an emergency fund can be lifesaving.…

-

Rebuilding Your Credit Score After Default: A Simple Recovery Guide

Experiencing a default on your loan or credit card payment can be a daunting experience, leaving you feeling overwhelmed and uncertain about your financial future. However, it’s crucial to remember that a default is not an insurmountable obstacle. With a combination of financial discipline, patience, and strategic action, you can effectively rebuild your credit score…

-

Personal Loan with a Low CIBIL Score: What You Need to Know

Personal loans can be an essential financial tool for many, providing much-needed liquidity for things like home renovations, education, medical emergencies, or travel. However, when it comes to securing a personal loan with a low CIBIL score, many people feel discouraged or even assume that getting one is out of the question. Let’s explore the…

-

How FinTechs Are Making the Finance Ecosystem More Sustainable

Fintech companies improving financial sustainability, inclusivity, and access to capital through innovative technology and digital transformation. Introduction Access to funds when required is a critical factor in the empowerment and development of underserved populations, especially in developing nations like India. For people who have traditionally faced exclusion from the formal financial ecosystem, the intervention of…

-

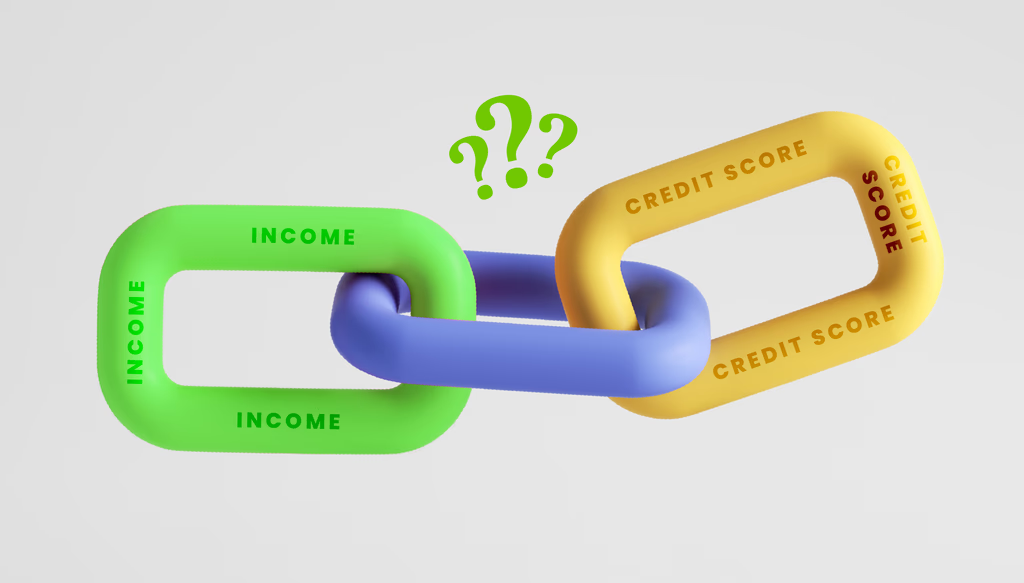

Your Income and Credit Score are Linked. Find out how.

In the world of personal finance, income and credit score are two key factors that shape your financial identity. Your income reflects your financial stability, while your credit score represents your creditworthiness. Both play a significant role in financial decisions, such as loan approval and interest rates. In this blog, we’ll explore how these two…

-

Be your own boss and ditch the 9-to-5 grind. Here’s your Launchpad!

Ever dream of calling the shots and building something awesome? Let’s ditch the boring office life and dive into the thrilling world of small business! Entrepreneurship is a bold move, but it’s also one of the most rewarding journeys you can take. Whether you want to leave your desk job or simply chase your passion,…

-

Importance of Checking Your Credit Report

Just as a report card summarizes a student’s academic performance, a credit report is a roadmap to your financial history and a mirror of your financial behavior. It provides a snapshot of your creditworthiness based on several factors such as payment history, credit utilization, and account status. A clear understanding of your credit report can…