Imagine this: You’re nestled in a cozy café, the aroma of freshly brewed coffee filling the air, and you’re finally taking a moment to unwind. Suddenly, your phone buzzes with a message – your dearest friend has just announced their engagement, and you’re invited to their dream destination wedding in Goa. Excitement floods you, but as you begin calculating the costs – travel, accommodation, gifts, and stylish attire – a wave of apprehension washes over you. Your savings won’t quite cover it. You need immediate funds, but where do you turn?

The thought of navigating your bank’s labyrinthine loan process fills you with dread, and you’re unsure if you’ll secure a fair deal. This is where personal loans emerge as a potential lifeline, offering a swift and convenient solution. But with a plethora of options available, how do you discern the right one for your specific needs?

In the bustling, vibrant, and ever-evolving landscape of modern India, financial agility is not just a luxury; it’s a necessity. Life, with its unpredictable rhythm, often presents us with moments that demand immediate financial intervention. Picture this: the joyous announcement of a loved one’s wedding, a sudden, urgent medical need, the dream of transforming your living space, or the tantalizing opportunity for an impromptu, well-deserved getaway. These are the moments that define our lives, but they also highlight the crucial need for readily available financial resources.

In a world where time is a precious commodity, the traditional avenues of securing financial assistance can often feel like navigating a maze. Lengthy paperwork, bureaucratic hurdles, and protracted approval processes can turn a moment of need into a prolonged period of stress and uncertainty. This is where the transformative power of personal loans comes into play, offering a lifeline to those seeking swift and seamless access to funds.

Personal loans, in their essence, are unsecured financial instruments, meaning they don’t require you to pledge any collateral. This makes them exceptionally accessible, particularly for individuals who may not possess substantial assets or have a long credit history. They offer the flexibility to address a wide range of financial needs, from covering unforeseen expenses to realizing long-cherished dreams.

However, the proliferation of lenders and loan products in the Indian financial market can be overwhelming. How do you cut through the noise and identify the personal loan that best aligns with your unique financial circumstances? How do you ensure that you’re not just securing a loan, but securing the right loan?

This comprehensive guide is designed to be your trusted companion in this journey. We will delve into the intricacies of personal loans, unraveling the complexities of interest rates, processing fees, loan tenures, and eligibility criteria. We will explore the advantages and disadvantages of digital lenders versus traditional banks, equipping you with the knowledge to make informed decisions.

Furthermore, we will provide you with practical, real-time scenarios to illustrate key concepts, enabling you to apply these insights to your own financial situations. Our goal is to empower you to navigate the landscape of personal loans with confidence, ensuring that you secure a financial solution that not only meets your immediate needs but also aligns with your long-term financial well-being.

In an era defined by speed and convenience, personal loans stand as a testament to the evolving nature of financial services. They offer a pathway to financial empowerment, enabling you to seize opportunities, overcome challenges, and build a brighter financial future. Let’s embark on this journey together.

Why Personal Loans Are a Lifesaver for Many Indians

In a nation as diverse and dynamic as India, personal loans have become indispensable financial instruments for countless individuals seeking to address immediate expenses without depleting their hard-earned savings. Whether it’s the joyous occasion of a wedding, the unforeseen challenge of a medical emergency, the aspiration of a home renovation, or the allure of a spontaneous vacation, personal loans provide the flexibility, rapid disbursement, and collateral-free access to funds that modern life demands.

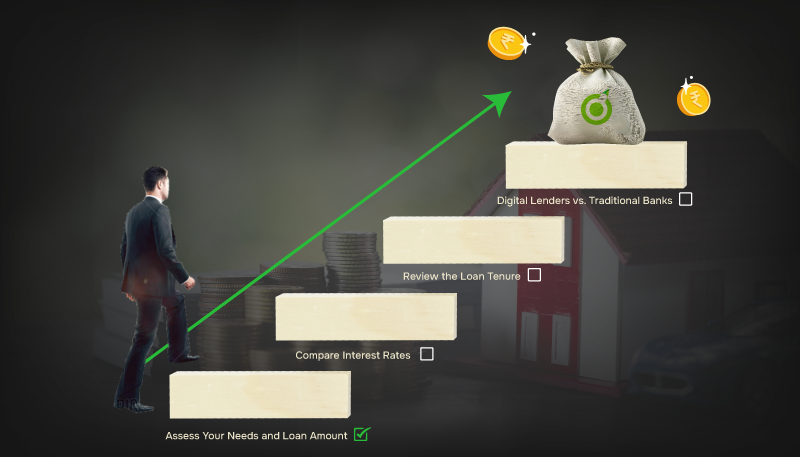

However, the pivotal question remains: How do you navigate the intricate landscape of personal loans in India to identify the optimal choice for your unique circumstances? Let’s embark on a journey to demystify this process, breaking it down into manageable steps and empowering you to make informed decisions.

1. Meticulously Assess Your Needs and Determine the Loan Amount

Before venturing into the realm of lenders, it’s imperative to conduct a thorough assessment of your financial requirements. Resist the temptation to borrow more than necessary, as loans are accompanied by interest charges that accrue over time.

Begin by meticulously itemizing your estimated expenses, incorporating a modest buffer to account for unforeseen contingencies. Many seasoned financial experts advocate adhering to a pre-defined budget to mitigate the risk of overspending.

For instance, if your calculations reveal a need for ₹3 lakh, restrict your loan application to that specific amount. Opting for a smaller loan translates to lower Equated Monthly Installments (EMIs) and expedited repayment, thereby minimizing your overall financial burden.

Real-Time Scenario:

- The Wedding Planner’s Dilemma: Priya, a budding wedding planner, receives an unexpected surge in client inquiries. To capitalize on this opportunity, she needs to invest in new equipment and marketing materials. She carefully calculates the costs and determines that ₹2.5 lakh will suffice. By adhering to this figure, she avoids unnecessary debt and ensures a manageable repayment schedule.

2. Scrutinize and Compare Interest Rates

Interest rates wield a significant influence over the overall cost of a loan. Even a seemingly minor percentage point difference can translate to substantial variations in the total amount repaid. In India, personal loan interest rates typically range from 12%* to 20%* per annum, contingent upon the lender, your creditworthiness, and other pertinent factors.

Prioritize lenders that offer competitive interest rates. To facilitate this process, leverage online comparison tools and obtain quotes from multiple lenders.

Industry surveys consistently indicate that borrowers with a CIBIL score exceeding 750 are more likely to secure the most favorable interest rates. Therefore, it’s prudent to ascertain your credit score before initiating the loan application process.

Real-Time Scenario:

- The Home Renovator’s Research: Rohan plans to renovate his apartment. He compares interest rates from three different banks and two fintech lenders. He discovers a 2% difference between the highest and lowest rates, which would save him thousands of rupees over the loan’s tenure.

3. Evaluate Processing Fees and Other Charges

Beyond interest rates, processing fees constitute another critical consideration. These fees depends on platform and banks, can accumulate rapidly. For instance, a 2% processing fee on a ₹5 lakh loan would result in an upfront cost of ₹10,000.

Furthermore, some lenders impose charges for prepayment or foreclosure, potentially subjecting you to penalties for early repayment.

Seek out lenders that offer minimal processing fees and refrain from imposing stringent prepayment penalties. Certain fintech lenders may even waive these charges during promotional periods.

Real-Time Scenario:

- The Medical Emergency: Anjali’s mother requires urgent surgery. She needs ₹4 lakh immediately. She finds two lenders offering similar interest rates, but one has a lower processing fee and no prepayment penalties. This makes it the more cost-effective option for her.

4. Analyze Loan Tenure and EMI Flexibility

When selecting a personal loan, ensure that the tenure aligns with your repayment capacity. In India, personal loan tenures typically span 12 to 60 months(which may vary depends on the platforms or Banks). While extended tenures result in lower EMIs, they also entail higher cumulative interest payments.

Consider the following illustration:

- A ₹5 lakh loan at 14% interest:

- A 1-year loan yields an EMI of approximately ₹45,000.

- A 3-year loan reduces the EMI to approximately ₹17,000, but incurs higher overall interest.

Strike a balance between affordability and total interest payout when determining the loan tenure.

Real-Time Scenario:

- The Student Loan: Vikram, a student, needs a loan for his higher education. He opts for a longer tenure to keep his EMIs manageable while he’s still studying. He plans to increase his payments once he starts earning.

5. Weigh the Merits of Digital Lenders vs. Traditional Banks

Digital lenders, such as the Olyv app, have revolutionized the Indian fintech landscape by providing rapid, hassle-free instant money loans. While traditional banks offer competitive rates, they often entail extensive paperwork and protracted disbursement timelines.

Digital Fintech Benefits:

- Instant loan approvals (often within minutes).

- Reduced documentation requirements.

- Accelerated disbursement.

Fintech lenders are increasingly becoming the preferred choice for individuals seeking swift access to funds. However, it’s crucial to verify that the digital entity providing the loan is affiliated with RBI-registered lenders.

Real-Time Scenario:

- The Travel Enthusiast: Neha wants to take a spontaneous trip to Europe. She chooses a fintech lender for its instant approval and quick disbursal, allowing her to book her tickets and accommodation without delay.

6. Scrutinize the Fine Print: Terms and Conditions

Prior to signing the loan agreement, meticulously review the terms and conditions.

Inquire about potential hidden charges and the repercussions of missed EMI payments.

Some lenders impose exorbitant penalties for payment defaults, which can severely impair your credit score.

Real-Time Scenario:

- The Business Owner: Suresh, a small business owner, carefully reads the loan agreement and discovers a clause about a penalty for early repayment. He negotiates with the lender to remove this clause, ensuring he has the flexibility to repay the loan early if his business performs well.

Additional Considerations

- Credit Score Importance: Your credit score is a crucial factor in determining your loan eligibility and interest rates. Maintain a healthy credit score by paying bills on time and avoiding excessive debt.

- Loan Purpose: Some lenders offer specialized personal loans for specific purposes, such as wedding loans or home renovation loans. These loans may offer better terms and conditions.

- Customer Service: Choose a lender with responsive and helpful customer service. This can be invaluable if you encounter any issues during the loan process.

- Pre-Approved Offers: If you have a good relationship with your bank, you may receive pre-approved personal loan offers. These offers often come with favorable terms and conditions.

- Loan Insurance: Consider purchasing loan insurance to protect yourself in case of unforeseen events, such as job loss or disability.

Finding the Perfect Fit: A Personalized Approach

Selecting the optimal personal loan in India is a personalized endeavor that necessitates a thorough understanding of your financial circumstances, a meticulous comparison of available options, and a judicious selection of a loan that aligns with your financial aspirations.

Whether you’re securing funds for a wedding, addressing a medical emergency, or embarking on a long-awaited vacation, personal loans can serve as a valuable financial safety net. However, it’s imperative to exercise prudence and make informed decisions.

So, the next time you find yourself enjoying a cup of coffee while contemplating a dream wedding or any other financial need, you’ll be equipped with the knowledge to navigate the landscape of personal loans and secure a swift, hassle-free instant money loan.

Choosing the right personal loan in India is more than just a transaction; it’s a strategic financial decision that can have a profound impact on your overall financial health. As we’ve explored in this guide, the key to making an informed choice lies in a meticulous assessment of your needs, a thorough comparison of available options, and a deep understanding of the terms and conditions associated with each loan product.

In the dynamic landscape of Indian finance, personal loans have emerged as a versatile and accessible tool, empowering individuals to address a wide array of financial requirements. Whether you’re planning a dream wedding, managing an unexpected medical expense, renovating your home, or simply seeking to consolidate existing debts, a well-chosen personal loan can provide the financial flexibility you need.

Remember, interest rates and processing fees are not the only factors to consider. Loan tenure, EMI flexibility, and the reputation of the lender are equally important. Take the time to compare offers from multiple lenders, both traditional banks and digital fintech platforms, to ensure that you’re securing the most favorable terms.

Moreover, prioritize transparency and clarity. Don’t hesitate to ask questions and seek clarification on any aspect of the loan agreement that you don’t fully understand. Remember, a reputable lender will always be willing to provide you with the information you need to make an informed decision.

In today’s digital age, the convenience and speed of online loan applications have revolutionized the lending process. However, it’s crucial to exercise caution and verify the credentials of any digital lender you choose. Ensure that they are registered with the Reserve Bank of India (RBI) and that they adhere to all applicable regulations.

Ultimately, the best personal loan is the one that aligns with your unique financial goals and circumstances. It’s a loan that you can comfortably repay, without placing undue strain on your budget. By following the guidance provided in this guide, you can confidently navigate the landscape of personal loans and secure a financial solution that empowers you to achieve your aspirations.

As you sip your coffee and ponder your next financial step, remember that knowledge is your greatest asset. With the right information and a thoughtful approach, you can transform financial challenges into opportunities for growth and prosperity. Personal loans are not just about borrowing money; they’re about investing in your future. Choose wisely, and you’ll be well on your way to achieving your financial dreams.